Building Financial Intelligence for Tomorrow's Founders

Most startup founders understand their product. But when investors start asking about burn rate, unit economics, or cap table management – that's where things get complicated. We teach the financial language that turns ideas into funded ventures.

Explore Our Program

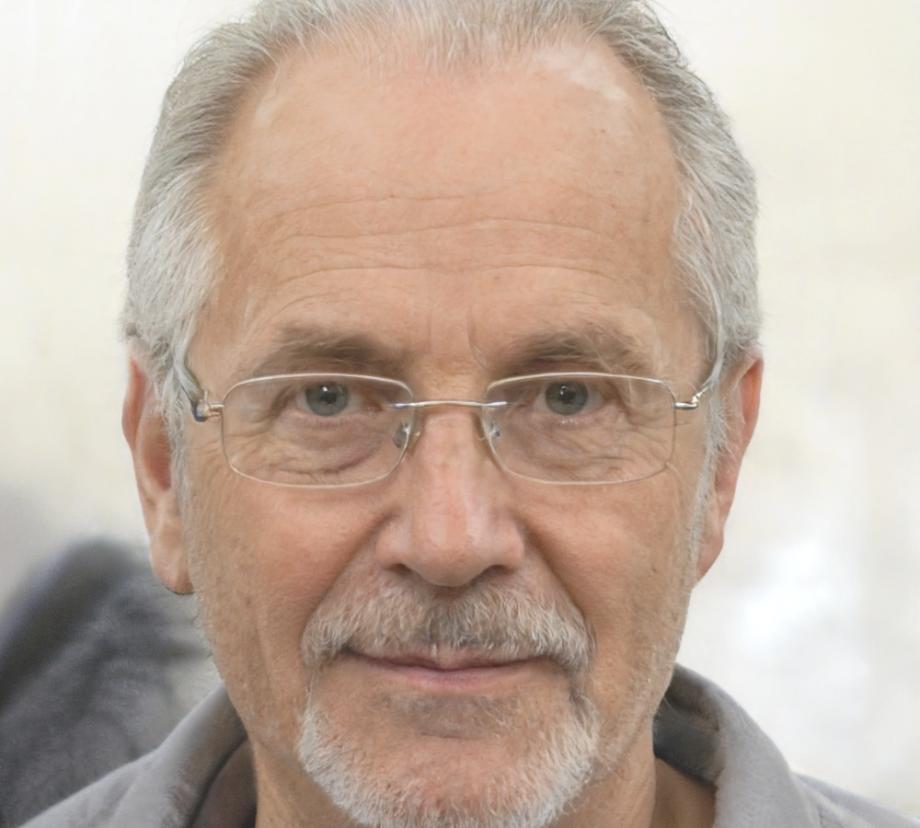

Darren Fitzwilliam

Program Director

Spent twelve years working with early-stage companies across Melbourne and Sydney. Watched brilliant founders lose momentum because they couldn't speak the language of finance.

Why Most Accelerators Skip the Important Stuff

The Reality Check

Accelerators love talking about growth hacking and viral loops. But when you're sitting across from a VC who just asked about your customer acquisition cost versus lifetime value – and you freeze – that pitch meeting is over. I've seen it happen dozens of times.

What Actually Happens

You build something people want. Early traction looks good. Then you realize you're spending $400 to acquire customers who generate $180 in revenue. Or you have three investors asking for different reporting formats and you're spending weekends in spreadsheets instead of building product.

The Missing Piece

Financial literacy isn't about becoming an accountant. It's about reading your numbers well enough to make better decisions on Tuesday morning. Should you hire that developer or spend on marketing? When do you actually need that next funding round? These questions have financial answers.

Foundations Track

This isn't an MBA program. We start with the financial statements you'll actually use – P&L, cash flow, balance sheet – and work backwards from real startup scenarios.

- Reading financial statements without getting lost in accounting jargon

- Building financial models that help you test assumptions, not just impress investors

- Understanding cash flow so you don't run out of runway three months before you planned

- Creating budgets that account for the reality of startup life

Program runs September through November 2025. Twelve weeks, one evening per week, plus access to our model templates and case studies.

Growth Strategy Track

You've got traction. Now investors are asking about unit economics, cohort analysis, and whether your business model actually scales. This track covers the financial strategy that supports growth.

- Building investor-ready financial projections that tell your growth story

- Understanding valuation methods and what they mean for your cap table

- Analyzing unit economics and making smart decisions about customer acquisition

- Managing equity distribution and avoiding common cap table mistakes

This track assumes you understand the basics. We dig into scenario planning, fundraising strategy, and the financial metrics that matter at different stages. Starts October 2025.

Questions We Hear from Founders

Wondering If This Is Right for You

I'm technical, not financial – will I keep up?

Most participants come from engineering or product backgrounds. We don't assume financial knowledge. If you can build a product roadmap, you can learn financial modeling.

Can I really learn this in twelve weeks?

You won't become a CFO. But you'll learn enough to have intelligent conversations with investors, make data-informed decisions, and know when you need professional help.

What if my startup is pre-revenue?

Perfect timing, actually. Understanding finances before you have complicated numbers makes everything easier later. We work with founders at all stages.

Making the Most of Your Time

How much time should I expect to invest?

Three hours in evening sessions, plus maybe two hours working through exercises on your own business. Some founders spend more because they find it useful.

Can I apply this to my actual startup?

That's the point. You'll build models using your real numbers. The final project is creating a financial plan for your business.

What Happens Next

Will I be ready to pitch investors?

You'll be ready to discuss your financials confidently. Whether you're ready to pitch depends on your business, not just your financial knowledge.

Do you offer ongoing support?

Alumni get access to our quarterly financial planning workshops and can book office hours when they're preparing for fundraising or facing complex financial decisions.

Learning Alongside People Who Get It

The best learning happens when someone can look at your specific situation and help you think through it. That's why every participant gets paired with someone who's been through the fundraising process.

These aren't formal mentorship relationships with monthly check-ins. It's more like having someone you can message when you're building a financial model at 11pm and can't figure out why your cash flow projections look weird.

Our teaching team includes people who've raised seed rounds, managed startup finance operations, and yes – made plenty of financial mistakes they can help you avoid.

Helena Lindström

Former CFO at two Brisbane-based startups. Now helps founders understand their numbers without needing to hire a full-time finance person. Specializes in early-stage financial planning and investor reporting.